Contesting Insurance Settlement Offers

While insurance companies promise to make you “whole”, the truth is they often use confusing computer reports filled with low-ball information.

We’ve been very successful aiding Homeowners who have suffered a loss due to water and/or fire damage by contesting their insurance company’s low-ball settlement offers.

While insurance companies promise to make you “whole”, the truth is they often use confusing computer reports filled with low-ball labor and material prices not related to the current prices charged by quality General Contractors, Sub-contractors & Suppliers in your area.

Our Process

We first create a Restoration Detailed Estimate which is broken down by Trade & Task, along with a Comparison Chart showing our RCC numbers against the insurance numbers to show where they are low, missing scope or have left out the costs of Code Upgrades.

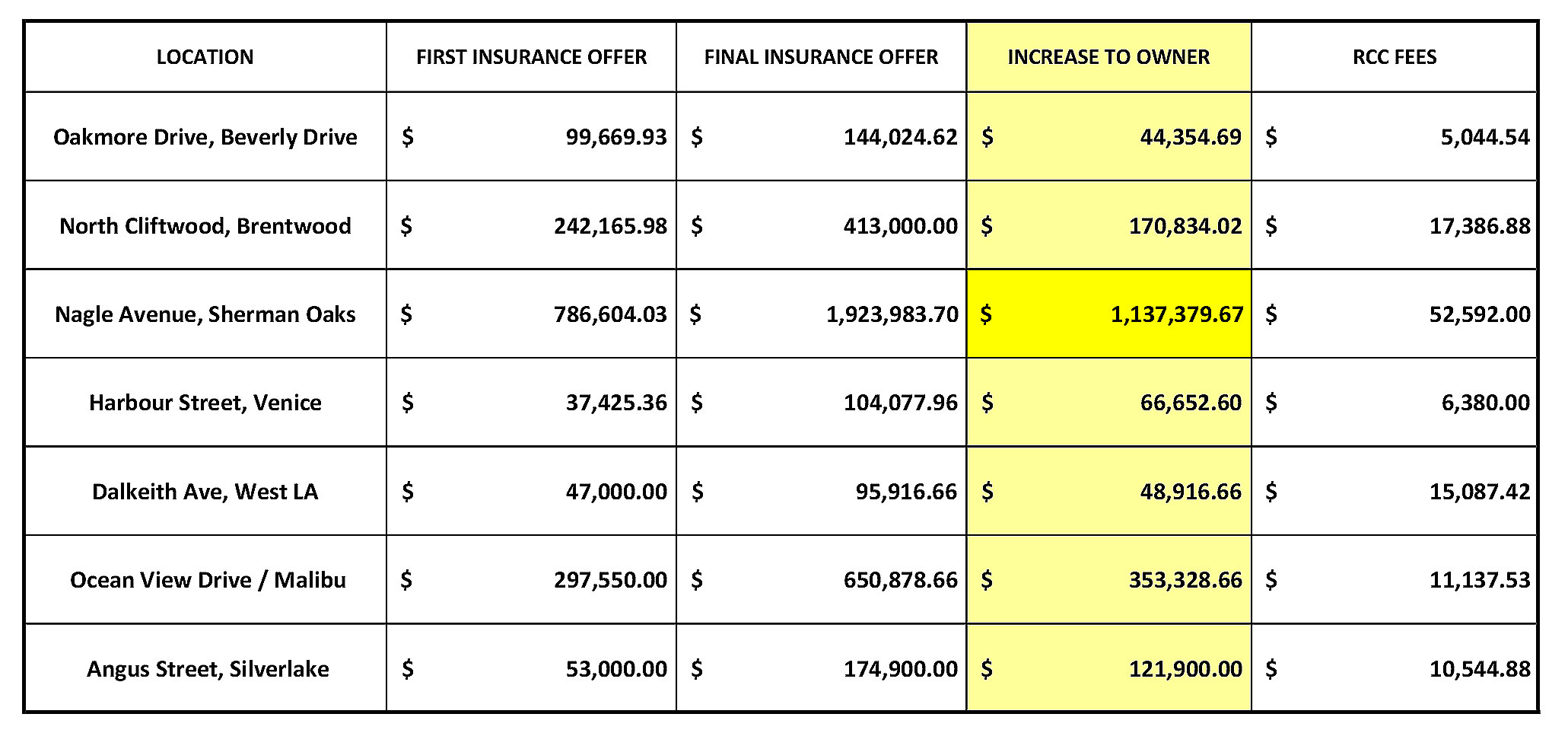

Once our Client receives a revised offer, we re-chart their numbers to show where they are still low, still missing scope and still missing the costs of Code Upgrades. This process sometimes takes 3 or 4 efforts. While we can’t guarantee your Insurance Company will do the right thing, it’s been our experience that you’ll receive a Final Settlement much higher than their initial offer, and which easily covers the cost of our fees as the following chart shows:

Related Services

Provide Service To Homeowners

We help Homeowners plan a major remodel or build their “Dream Home” by knowing what should be included, what it costs and the right questions to ask of your General Contractor.

Support Legal Action Against Negligent Contractors

We’ve had great success supporting Homeowners bringing legal actions against General Contractors who were negligent or performed poorly on major remodels or new construction..

Provide Service To Contractors

We help General Contractors reduce stress and produce an overall bid that safeguards profits yet stays competitive by seeing budgets include the entire scope of the project.